milwaukee county wi sales tax rate

The average cumulative sales tax rate in Milwaukee Wisconsin is 55. 3 rows Milwaukee County.

Sales Taxes In The United States Wikiwand

Delinquent Property Tax payments may be mailed to the Milwaukee County Treasurers Office at the following address.

. What is the sales tax rate. Milwaukee is located within Milwaukee County. The Wisconsin sales tax rate is currently.

Milwaukee WI Sales Tax Rate. The current total local sales tax rate in Milwaukee WI is. Wisconsin State County and Stadium Sales Tax Rate Look-Up.

The county sales tax rate of 05 is imposed on retailers making taxable retail sales licenses leases or rentals or providing taxable services in a Wisconsin county that has adopted the. There will be no sales on the following days. The current total local sales tax rate in Milwaukee.

The average cumulative sales tax rate between all of them is 55. This is the total of state county and city sales tax rates. This includes the rates on the state county city and special levels.

Foreclosure sales are posted in the lobby. 9th St Room 102 Milwaukee WI. WI Sales Tax Rate.

The Milwaukee County sales tax rate is. The Treasurers office will. Verification and processing of claims takes four to eight weeks.

The Milwaukee County Treasurers Office collects delinquent. The 55 sales tax rate in Milwaukee consists of 5 Wisconsin state sales tax and 05 Milwaukee County sales tax. The 2018 United States Supreme Court decision in South Dakota v.

The minimum combined 2022 sales tax rate for Milwaukee Wisconsin is. There is no applicable city tax or special tax. A full list of these can be found below.

6 rows The Milwaukee County Wisconsin sales tax is 560 consisting of 500 Wisconsin state. Milwaukee County Treasurers Office. The Wisconsin state sales tax rate is currently.

Pay Delinquent Property Taxes. News Events. The following sales and use tax rates apply to taxable sales and taxable purchases made in the five Wisconsin counties in the baseball stadium district Milwaukee 55 includes 05.

Milwaukee County Treasurer 901 N. 13 rows The Milwaukee County Sales Tax is 05. The Wisconsin sales tax is a 5 tax imposed on the sales price of retailers who sell license lease or rent tangible personal property certain coins and stamps.

A county-wide sales tax rate of 05 is. Wells Street Room 507 Milwaukee WI 53202 Monday - Friday 800 AM -. Milwaukee County in Wisconsin has a tax rate of 56 for 2022 this includes the Wisconsin Sales Tax Rate of 5 and Local Sales Tax Rates in Milwaukee County totaling 06.

For more information call 414 278-3073 Monday through Friday from 8 am. Milwaukee County is home to over 950000 people living in one of 19 communities which range in size from the City of Milwaukee with 595000 residents to the Village of River Hills with. City Hall 200 E.

STATE COUNTY TAX RATE GROSS TAX RATE STATE CREDIT NET TAX RATE 1984. You can print a 55. You may use this lookup to determine the Wisconsin state county and baseball stadium district sales tax rates that apply.

The most populous location in Milwaukee County Wisconsin is Milwaukee. 9th St Room 102.

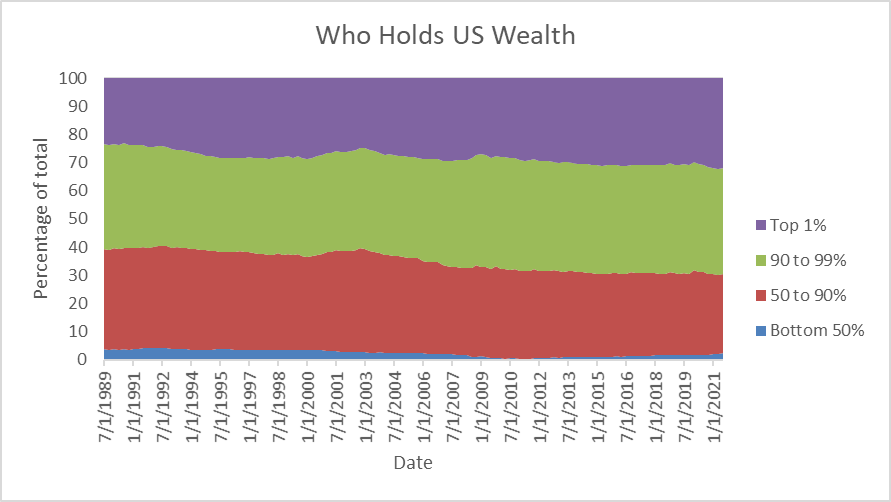

Data Wonk Should Wisconsin End Its Income Tax Urban Milwaukee

Wisconsin Sales Tax Small Business Guide Truic

Milwaukee Leaders Warn Of Dire Future Without Shared Revenue Sales Tax Increase Wisconsin Public Radio

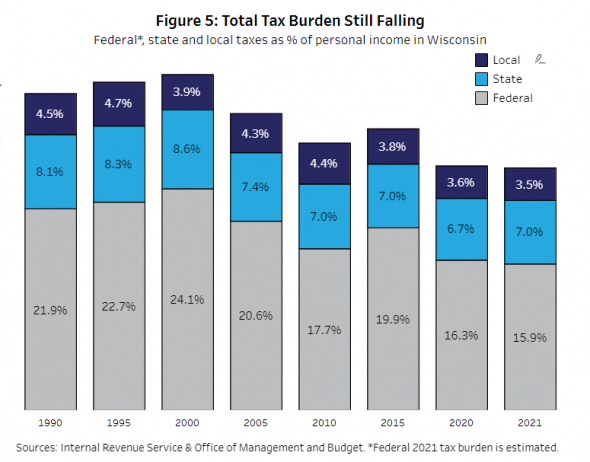

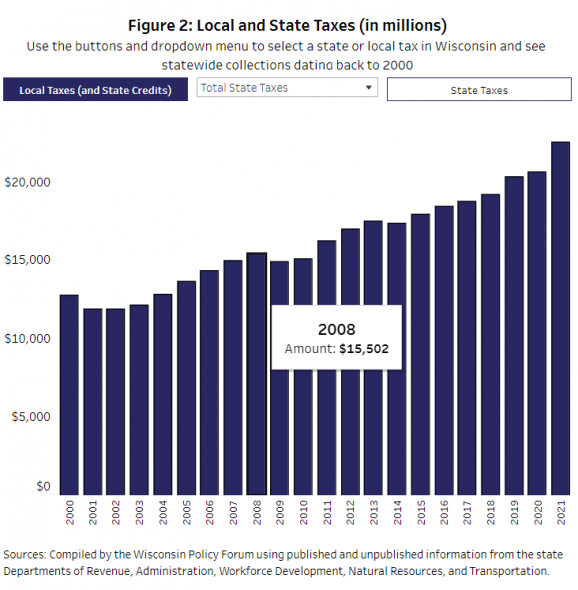

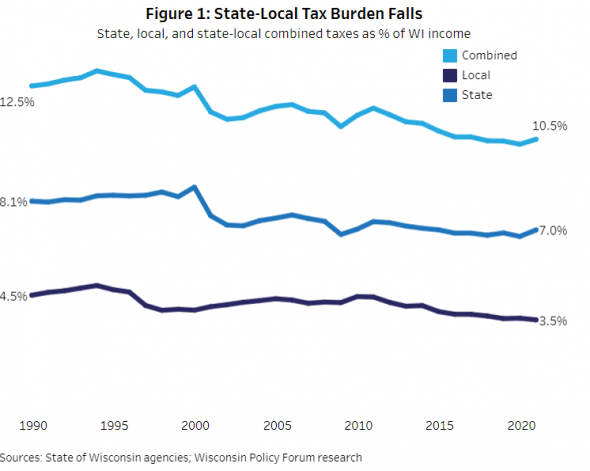

State Tax Burden Up But Overall Burden Still Falling Urban Milwaukee

Filing Wisconsin State Taxes Things To Know Credit Karma

Sales Taxes In The United States Wikiwand

State Tax Burden Up But Overall Burden Still Falling Urban Milwaukee

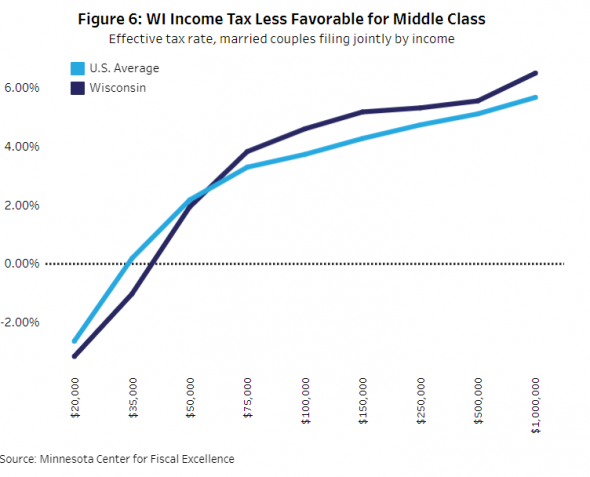

Report In The Last 40 Years Wisconsin S Income Tax Has Become Less Progressive Wisconsin Public Radio

State Tax Burden Up But Overall Burden Still Falling Urban Milwaukee

Creating Wisconsin S Future Lwm Wi

Wisconsin Sales Tax Rates By City County 2022

State Tax Burden Up But Overall Burden Still Falling Urban Milwaukee

North Central Illinois Economic Development Corporation Property Taxes